Optimise Your Personal Finances with Expert Accounting Solutions

We provide personal tax services, intergenerational wealth planning, and expertise in cryptocurrency and NFTs, helping clients with compliance and tax implications.

We provide personal tax services, intergenerational wealth planning, and expertise in cryptocurrency and NFTs, helping clients with compliance and tax implications.

We serve high-net-worth individuals in diverse industries, both in London and beyond. With our extensive expertise, we've created specialised areas to meet unique client needs from varied backgrounds.

We are a professional accounting agency located in North West London, dedicated to providing our clients with personalised solutions for their unique personal financial needs. We understand that every client has individual requirements, and we pride ourselves on offering a tailored approach to meet these needs. Our diverse client base includes high-net-worth individuals and professional partnerships.

Our team of expert accountants and consultants work closely with our clients to understand their goals and develop customised solutions. We offer a range of personal services including Tax Planning and Advice, Tax Returns and Compliance, Tax Investigations, Remuneration Planning, Non-Resident Landlords, and Inheritance Tax Planning.

We also offer Business Consultancy and Planning, Payroll Services, Company Secretarial, Auditing, Auditing Reviews, and Working Capital Management services. With our personalised approach, you can be confident that your personal financial needs are in the hands of experts who are committed to helping you achieve your goals.

Our Personal Services

Cryptocurrency & NFT

At Wisteria, we understand the rapidly evolving landscape of the financial industry, and we're committed to providing innovative solutions to our clients. That's why we're pleased to offer cryptocurrency and non-fungible token (NFT) services to our personal clients. We can assist you with tracking your cryptocurrency transactions, preparing tax filings related to cryptocurrencies, and providing guidance on best practices for managing your cryptocurrency and NFT assets.

Intergenerational Wealth Planning

We believe in helping our clients secure their financial future for generations to come. That's why we offer Intergenerational Wealth Planning services to our personal clients, including high-net-worth individuals. Our team of experienced professionals can help you create a comprehensive plan that addresses your long-term goals and ensures that your wealth is passed down to your loved ones in a tax-efficient manner. We can provide guidance on estate planning, trusts, charitable giving, and other strategies that can help you achieve your goals and protect your assets.

Tax Services

We're here to provide comprehensive Tax Services to help you stay compliant and minimise your tax liability. Our team of experienced professionals can assist you with tax preparation, planning, and compliance, as well as provide guidance on tax-related issues such as payroll taxes, sales taxes, and international tax matters. We stay up-to-date with the latest tax laws and regulations to ensure that you are taking advantage of all available tax-saving opportunities. With our personalised approach, we can work with you to develop a tax strategy that is tailored to your unique needs and circumstances.

Personal Financial Services for High-Net-Worth Individuals

Our team of tax experts is committed to providing personalised tax solutions to established individuals like yourself. We cater to your specific needs and offer an extensive range of tax services, such as filing Corporation Tax returns, identifying and claiming capital allowances, securing R&D Tax Relief, providing guidance on international tax issues, and assisting in devising a tax-efficient exit strategy.

We are well-versed in the intricacies of tax laws and have prior experience dealing with complicated tax inquiries and investigations. Additionally, we can offer share scheme advice to incentivise and retain top-tier talent.

Our approach is forward-thinking, as we regularly review your financial situation to spot potential tax-saving opportunities at the earliest. With our support, you can take advantage of every possibility and optimise your tax position.

FAQs

Personal

Can I do my own accounting?

It’s possible to do your own accounting. However, hiring an accountant can provide numerous benefits to a business. By entrusting your financial matters to a professional, you can free up valuable time and resources that would otherwise be spent on bookkeeping and tax preparation. An experienced accountant can provide valuable insights and recommendations to help you make informed business decisions, and ensure that you stay compliant with tax laws and regulations. They can also help you identify opportunities for cost savings and provide guidance on how to improve your financial performance. In short, hiring an accountant can provide a wealth of benefits to a business and is an investment that can pay off in the long run.

How can Wisteria help with inheritance tax planning?

Wisteria offers intergenerational wealth planning services, which can provide guidance on how to manage inheritance tax, particularly in areas with high property prices.

Why should small businesses consider using Wisteria's payroll services?

Small businesses often have limited time and resources to manage their payroll effectively. Wisteria can walk businesses through the payroll process and ensure that it is done accurately and on time.

How can Wisteria help with non-resident landlord tax returns?

Wisteria offers expert guidance on the technicalities of non-resident landlord tax options for those considering investing in the property market.

What services does Wisteria offer for landlords?

Wisteria offers a range of services for landlords, including property advice, accounting services, tax advice, and non-resident landlord tax options.

What are the benefits of hiring an accountant?

Hiring a good accountant is a wise decision for any business; an accountant can help you save money and stay on top of your finances. When you work with an experienced accounting firm like Wisteria, you can rest assured that your books are in good hands. Every business owner understands the importance of handling their financial information with care. Shelving and filing receipts and invoices, managing bank accounts, tracking payroll records and preparing tax returns are all important tasks for any business owner to complete. Hiring a professional accountant can free up your time to focus on other aspects of your business that require attention and growth.

Why should landlords consider property accounting services or tax advice?

Tax and accountancy rules for landlords and property investors are changing, and accessing property accounting services or tax advice can help landlords stay compliant and minimise their tax bills.

Why is hiring an accountant important?

A good accountant can help reduce or eliminate the time spent on financial tasks, allowing you to focus on growing your business and generating profits. The burden of handling those tasks will no longer be on your shoulders. An accountant will document your income and record how you spend your money so that you can focus on growing your business by making it more profitable.

Why is it important to seek support during a tax investigation?

Tax investigations can be stressful and overwhelming, and it is essential to seek experienced and knowledgeable support to navigate the complexity of tax rules and penalties. Wisteria can provide the necessary guidance during this time.

Does Wisteria provide support to landlords and property businesses?

Yes, Wisteria works with many buy-to-let landlords and property businesses providing support in relation to accounting, financial, and tax affairs.

Client Feedback

See what other customers have to say!

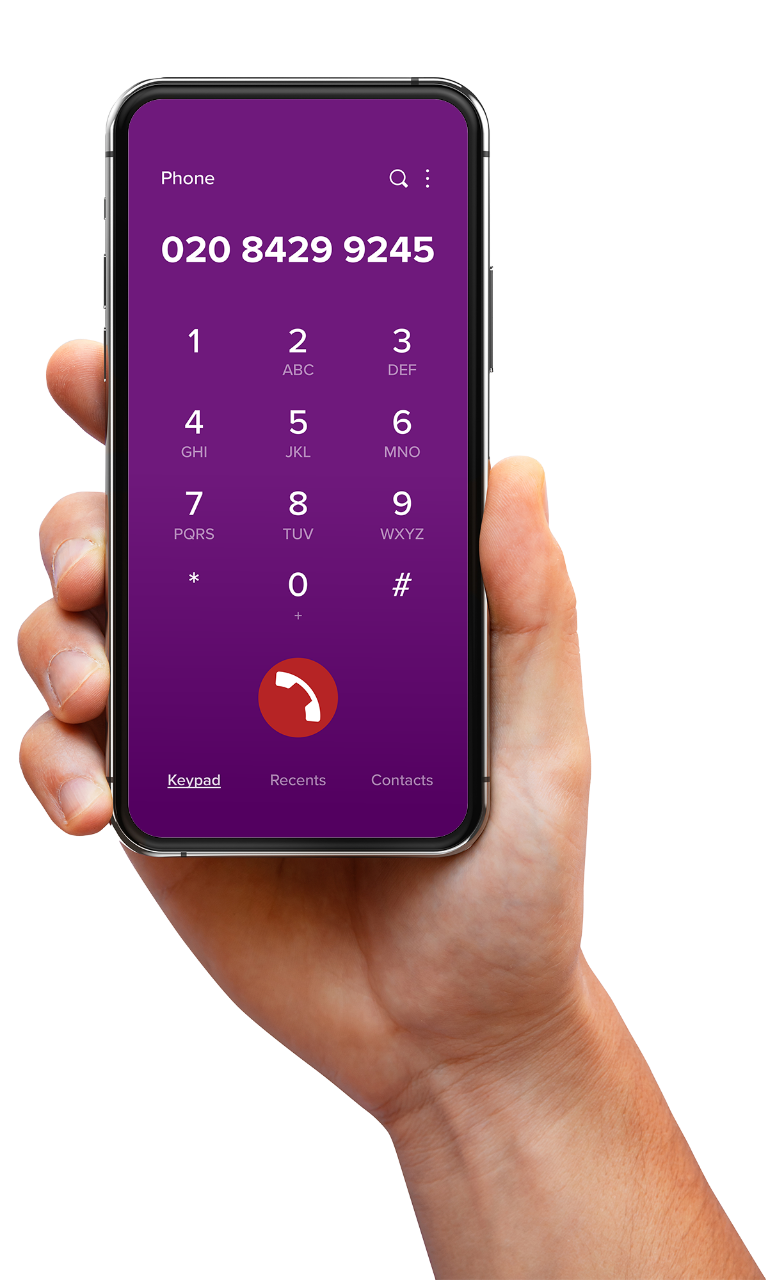

ReviewsRequest a call back

Please fill out the form below and we will contact you as soon as possible.